04 Oct Private Debt Market and Outlook (Q1-24)

A Time for Turn-Arounds (Q1-24)

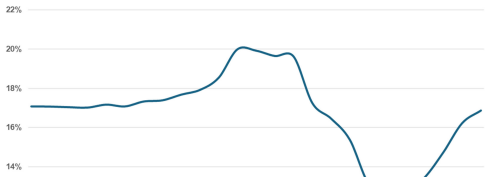

The rise in financing costs over the past two years combined with slowing economic growth have posed severe challenges for many businesses. Since 2022, the debt-servicing costs for publicly listed businesses headquartered in Canada have surged dramatically, following a period of decline in the preceding years (see Chart 1).

Chart 1: Interest expenses as a share of earnings, 4-quarter moving average

Source: Financial Stability Report 2024, Bank of Canada.

However, this data captures just 0.25% of the approximately 1.3 million active businesses with employees in Canada, and therefore understates servicing costs since most publicly-listed businesses primarily finance through fixed-rate bonds rather than floating-rate bank loans. In addition, about two-thirds of these bonds currently have a remaining maturity of five years or more, meaning for many listed firms, financing costs will not increase for some time. Although interest costs as a share of earnings remain below pre-pandemic levels, they are poised to escalate in the coming years as existing debt is refinanced at higher interest rates.

The financial strain on businesses is intensifying especially for smaller firms. The number of businesses in Canada filing for insolvency, which had been unusually low during the pandemic, has now surpassed pre-pandemic levels by a large margin. Business insolvencies in Canada surged by 87.2% in the first quarter of 2024 compared to the same period last year, marking the sharpest increase in the 37-year history of records from the Office of the Superintendent of Bankruptcy. This unprecedented rise underscores the profound economic challenges that Canadian businesses are currently facing. Over two thousand (2,003) businesses filed for insolvency in the first quarter of 2024, marking the highest volume since the recession in 2008.

The surge in insolvencies over the past 12 months has generally been: (i) concentrated among small businesses, (ii) broad-based across industries, and (iii) driven by bankruptcy filings rather than insolvency proposals. A rebound in business insolvencies from pandemic lows was to be expected. Some businesses may have been sustained throughout the pandemic by government support programs and the forced compassion of banks. Successive pandemic lockdowns also disrupted the insolvency filing process, particularly the use of bankruptcy courts, leading to a backlog of cases.

Notably, small and medium-sized businesses face unique challenges today, often lacking the resilience and access to capital that larger companies possess, leaving them with more limited options for restructuring. Moreover, some business owners may opt to cease operations altogether rather than pursue formal insolvency proceedings. These business failures are not included in the official insolvency statistics.

Filings for large debtor restructurings under the Companies’ Creditors Arrangement Act (CCAA) jumped over 40% in the first quarter of 2024 compared to the same period last year. For ten years until the pandemic in 2020, there were an average of 34 CCAA filings per year. In 2020, 60 CCAA proceedings were commenced, a record-high consequence of the pandemic. For the twelve months ending March 31, 2024, there were an astounding 72 CCAA filings, with 24 of them in the first quarter of 2024 alone. Given that the average length of a CCAA proceeding as measured from the date of the initial order to the date of the monitor’s discharge is 620 days (or slightly more than one year and eight months), the actual outcome of the latest proceedings is still unknown. The best CCAA outcome is when a debtor company uses the breathing space provided by the proceedings to restore solvency without needing to reorganize or liquidate. No plan is presented to creditors, no assets are sold, and the debtor company exits as a going concern business. Unfortunately, less than 1% of all CCAA proceedings result in such an ideal outcome. The total liabilities represented by debtors in CCAA filings during the first quarter of 2024 were $4.2 billion, $2 billion more than the previous quarter, and two-thirds of which constituted secured credit.

The rising number of insolvencies and CCAA filings highlights the growing strain on businesses and underscores the precariousness of the current economic environment. Given these conditions, significant losses should be expected for creditors of these debtors. the tendency by lenders to employ strategies to buy time and restructure quietly and informally is a historical precedent that goes back to the Babylonian Financiers. As businesses and their lenders engage in these quiet negotiations and restructuring efforts, the real scale of financial distress may not be immediately apparent, potentially leading to more pronounced financial repercussions down the line. In its latest Financial Stability Report, the Bank of Canada acknowledges that it is closely watching the rise of business insolvencies but believes that it does not currently represent a significant source of concern for the credit performance of banks.

Credit performance at Canada’s “Big 6” banks remains strong, with capital and liquidity buffers continuing to exceed regulatory minimums. Business lending comprises about 40% of the total lending by Canadian banks, with loans to small and medium-sized businesses (“SMBs”) making up a relatively small share. According to the Bank of Canada, loans to SMBs, categorized as loans of $5 million or less, account for only 8.5% of total business loans. The liabilities of insolvent businesses (as declared at the time of filing) totaled about $11.4 billion in 2023. Even under the extreme assumption that all of these liabilities were owed in the form of bank loans, this would represent only about 0.7% of all outstanding bank loans to incorporated businesses.

Banks have increased loan-loss provisions on their business loans, serving as an early line of defence to absorb credit losses. Allowances for loan losses at the Big 6, expressed as a percentage of loan balances, were 20% higher in the first fiscal quarter of 2024 (three months ending January 31, 2024) than before the pandemic. Banks also continue to maintain ample buffers to meet unexpected liquidity needs and absorb unexpected losses. As of the first fiscal quarter of 2024, the average common equity Tier 1 capital ratio of large banks was 13.4%, about 2 percentage points higher than just before the pandemic and the highest regulatory capital ratio they have ever achieved, largely due to the phase-in of mandated debt stability buffers.

Canadian banks appear to be weathering a softening economy brought on by higher interest rates, as evidenced by better-than-expected fee-based earnings from capital markets and wealth management offsetting weak credit performance. Given the lagging nature of credit, provisions for credit losses (“PCLs”) are expected to move higher in 2024 relative to reported targets. PCLs for Stage 3 loans (i.e., non-performing, impaired loans) have risen faster than expected, which is not surprising given the rise in business insolvencies and CCAA filings. Overall loan write-offs have spiked and are above pandemic peaks. All these factors portend weaker credit growth over the near term and the Big 6 anticipate continuing to build reserves on Stage 1 and Stage 2 loans (i.e., performing loans) through the year.

Non-bank lenders, including private debt funds, benefit from reduced bank credit availability through greater lending opportunities and higher spreads. However, these lenders also account for the largest proportion of CCAA filings. In Q1-2024, 61% of CCAA filings with affected secured creditors involved a private debt fund, half of which were non-Canadian. The filings with the largest liabilities usually involved a U.S.-based private debt fund. Non-bank lenders are more inclined to resolve defaults out-of-court since recoveries are higher and reputational risks are lower; thus, the higher proportion of private debt funds involved in expensive and potentially prolonged CCAA proceedings likely means greater losses for these lenders.

As the impact of higher interest rates ripples through credit markets, a larger number of firms will experience significant credit stress, whether due to individual circumstances or broader credit conditions. This suggests a greater need for managers with business turnaround skills and restructuring experience and a more permanent role for special situations investments in private debt portfolios.